ZAKAT FAQs

-

How is my total Zakat amount calculated?

Your Zakat is calculated by adding all qualifying assets, deducting eligible short-term liabilities, and applying the fixed 2.5 per cent rate. This calculation reflects surplus wealth held above the nisab threshold for one full lunar year, in accordance with Islamic guidance.

-

Can I review how my Zakat was calculated?

Yes. You can view a breakdown showing total assets, liabilities, and the applied Zakat rate. This transparency helps you understand how your amount was calculated and reassures you that your obligation has been assessed accurately and fairly.

-

What happens after I choose my Zakat donation?

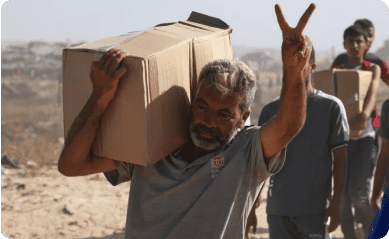

Once you choose your Zakat donation, the funds are managed separately and distributed to eligible recipients in accordance with Islamic law. Islamic Help ensures careful assessment, responsible distribution, and full accountability so your Zakat reaches those entitled to receive it.

-

What information do I need before using the Zakat calculator?

You only need details of your qualifying assets and short-term liabilities. This includes cash, savings, gold or silver, investments, and debts due within the year. Having an overview of your finances helps ensure your calculations accurately reflect your true surplus wealth.

-

Does the calculator include all types of Zakat?

This calculator is designed for Zakat al-Mal, which is based on accumulated wealth. It does not calculate Zakat al-Fitr, which is paid separately during Ramadan. Each form of Zakat has different rules, timings, and purposes under Islamic guidance.

-

Can I calculate Zakat if my finances change during the year?

Yes. You can calculate Zakat at any time, but it only becomes obligatory if your qualifying wealth remains above the nisab threshold for one full lunar year. If your finances change significantly, reviewing your position helps ensure accuracy and confidence.

-

Is this calculator suitable for business owners?

Yes. Business owners can include trade-related assets, such as inventory and cash. Operational tools, equipment, and fixed assets are generally excluded. If your situation is complex, this calculator offers a helpful estimate based on standard Islamic principles.

-

Why does the calculator ask about liabilities?

Liabilities help determine your net surplus wealth. Short-term debts due within the same lunar year may be deducted so Zakat is calculated fairly. This ensures you are not paying Zakat on wealth already committed to essential financial obligations.

-

Why is no Zakat due if I’m below the nisab?

Zakat is only obligatory when surplus wealth exceeds the nisab threshold and remains above it for one lunar year. If your wealth falls below this level, Islam does not require payment, protecting individuals from hardship while still rewarding sincere intention.

-

Should I still give if I’m below the nisab?

While Zakat is not required below the nisab, voluntary charity remains encouraged. Giving what you can, even in small amounts, is a virtuous act that supports those in need and allows you to participate in charitable impact without obligation.

-

Will I need to recalculate later?

Yes. Financial circumstances change, so it is recommended to reassess your wealth regularly. If your assets later exceed the nisab and remain above it for a full lunar year, Zakat may become due at that time.

-

How is my Zakat used by Islamic Help?

Islamic Help treats Zakat as a sacred trust. Funds are kept separate, assessed carefully, and distributed only to eligible recipients. This ensures your Zakat is used correctly, responsibly, and in full accordance with Islamic principles and donor intention.

-

Can I track or manage my future giving?

Yes. By registering an account, you can keep a record of your donations, set reminders, and manage your giving with ease. This helps you stay consistent, organised, and confident in fulfilling your Zakat and other charitable acts.

-

Can I set a yearly Zakat reminder?

Yes. Setting a yearly reminder helps ensure you never miss your Zakat obligation. It encourages timely reflection on your wealth, supports accurate calculation, and helps you fulfil this pillar of Islam with confidence and peace of mind each year.