Zakat

A small act of Sadaqah can lift hunger, heal hearts, and bring you closer to Allah’s mercy. Give what you can and uplift someon

What is Zakat?

Zakat is a compulsory act of charity and one of Islam’s five pillars. Every eligible Muslim must donate 2.5% of their surplus wealth each year to those in need. This spiritual duty purifies your wealth and soul, reminding you that all blessings come from Allah. By giving Zakat, you uphold social justice and provide life-changing support to the poor. It is a powerful way to worship Allah and uplift communities.

“An Islamic quote that relates to this form of giving. If there is no specific quote appropriate, a general quote on the importance of giving that could still relate to project”

Who must give Zakat?

Zakat becomes obligatory when a Muslim’s wealth exceeds the nisab, a minimum threshold value, for a full year. Adult, sane Muslims who own savings beyond their essential needs must pay.

Gold, silver, cash, investments, and business goods count towards nisab. If your assets stay above this level for a year, you owe Zakat. This ensures that only those with financial stability give, helping redistribute wealth to the vulnerable.

Why is Zakat necessary?

Zakat is not just a duty; it’s a beautiful form of worship with immense benefits. Your Zakat reaches eight categories of deserving people, from the poor and orphans to travellers in need. By giving, you cleanse your heart of greed and earn Allah’s blessings.

Zakat strengthens the entire community, easing poverty and suffering. It transforms lives: when you donate Zakat sincerely, you bring hope, dignity, and relief to those who need it most.

“An Islamic quote that relates to this form of giving. If there is no specific quote appropriate, a general quote on the importance of giving that could still relate to project”

How much is Zakat, and how to give it?

Zakat is set at 2.5% of your qualifying wealth. This means if you have £10,000 above your needs, you would give £250 as Zakat. It’s easier than ever to calculate and give your Zakat; many tools and calculators can help determine your exact due amount.

Donate your Zakat confidently through trusted channels, knowing it will be distributed in accordance with Islamic guidelines to those who genuinely need your help.

How your [Islamic giving type] are used

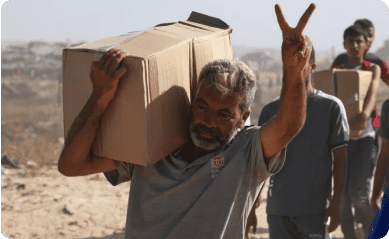

Write a short, factual paragraph showing where and how donations are used. Focus on clear impact – food, shelter, education, or healthcare – while linking to dignity and lasting

change. Keep the tone transparent and reassuring, showing funds reach vulnerable communities through trusted, field-led programmes using field photos or videos where available.

Your skills can make a real difference. See our latest opportunities.

Download PDF Report

Zakat brings dignity. Use our calculator to give with ease. Give your Zakat, change a life.

Faith Project Impact

in numbers

Use this section to highlight Islamic Help’s strongest results in Water Aid. Write a short introductory paragraph of two to three sentences that explains the scale of IH’s work – for example how many wells have been built, families reached, or communities supported. Keep the language uplifting and focused on real outcomes. This text should set the stage for the scrollable stat cards below, which will carry the specific figures.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

“An Islamic quote that relates to this form of giving. If there is no specific quote appropriate, a general quote on the importance of giving that could still relate to project”

Frequently Asked Questions

-

Who is required to pay Zakat?Zakat is obligatory on adult Muslims who own wealth above the nisab threshold for a full lunar year. This includes cash, savings, gold, silver, investments, and business assets. Every day, personal belongings, such as your home, clothing, or car, used for daily needs, are excluded from Zakat calculations. This ensures fairness and consistency in supporting those entitled to receive assistance.

-

How is Zakat calculated on wealth?Zakat is calculated by assessing all eligible assets and subtracting short-term liabilities. If the remaining amount exceeds the nisab value, 2.5% is payable. Common assets include cash, bank savings, trade goods, investments, and precious metals held for personal ownership rather than daily use. Accurate calculation helps fulfil this obligation correctly and avoids underpaying or overpaying.

-

Who can receive Zakat donations?Zakat must be given to specific eligible recipients outlined in Islamic teachings, including the poor, needy, those in debt, and travellers in hardship. It cannot be given to close dependents such as parents, children, or spouses, as supporting them is already a personal obligation. These guidelines ensure Zakat reaches those Islam prioritises for financial support.

-

What happens if Zakat is delayed or missed?When Zakat is delayed without a valid reason, it remains a debt owed and should be paid as soon as possible. Missing a payment does not remove the obligation. Muslims are encouraged to calculate accurately and give promptly to avoid accumulating unpaid Zakat over multiple years. Paying promptly helps purify wealth and supports those relying on timely assistance.

-

What is the difference between Zakat and Sadaqah?Zakat differs from voluntary charity because it is a compulsory act of worship with fixed rules, rates, and eligible recipients. Sadaqah, by contrast, can be given at any time, in any amount, and to anyone in need, making it a flexible form of generosity. Both forms encourage generosity but serve different spiritual and social purposes.

-

Can Zakat be paid in advance?Yes, Zakat can be given at any time once it becomes due, and many choose to pay it in advance. Early payment is allowed if your wealth remains above the nisab threshold, helping provide timely support to those in need throughout the year. This flexibility can be invaluable during times of widespread hardship

Real Stories, Real Impact

IH newsroom

The Grandmother who raised a village by herself

Stitching Hope: Sewing Machines Creating Futures with Dignity