What Is Zakat? Meaning, Rules, and Why It Matters in Islam

Zakat is one of the five pillars of Islam and a compulsory act of worship for eligible Muslims. It is an obligatory charity that requires those who meet specific conditions to give a portion of their qualifying wealth to those entitled to receive it. For many people, the most important point is this: it is not a general donation or an occasional act of kindness. It is a defined religious obligation with clear rules, purpose, and recipients.

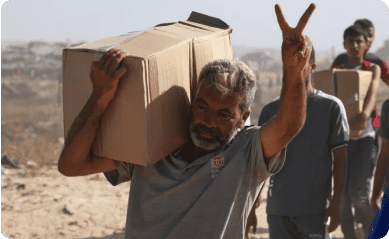

In Islam, wealth is viewed as a trust from Allah. People earn, save, and grow their resources, but they are not the ultimate owners of them. This duty ensures that surplus wealth is shared responsibly, helping individuals purify wealth, support those facing hardship, and strengthen the wider Muslim community. When fulfilled correctly, it benefits both the giver and the recipient.