Sadaqah vs Zakat: Key Differences Explained

Introduction

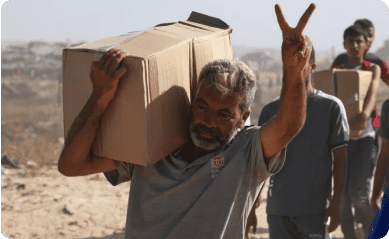

Charity is a central part of Islamic life, but not all charity is the same. Many Muslims want clarity on sadaqah vs. zakat, two forms of giving often mentioned together but serving different purposes.

Both are important charitable acts and deeply rewarded. However, Zakat is an obligation, while Sadaqah is voluntary. Understanding this difference helps Muslims fulfil their religious duties correctly and practise giving charity in Islam as Allah has prescribed.